Find the best immigration programs for you

Advertisement

Getting travel medical insurance for Canada that works for you can be a minefield. With so many providers giving a multitude of options, rates, add-on and variables, the whole process can be overwhelming. Hopefully, a bit of insight and preparedness will help you make a good decision, one that will allow you to choose the right travel health insurance package.

Please see our Travel Insurance for Canada page, where you can explore your options with a list of recommended insurance providers.

Note: Insurance is mandatory to get a Working Holiday Visa in Canada. If you land in Canada and are asked to provide your insurance details and cannot do so, you will not receive your visa. Ensure also that your covered for the full duration of the work permit you’re hoping to receive. Additionally, it just makes sense to be insured.

1. What is the maximum length of coverage for travel medical insurance in Canada?

Once you get your Port of Entry (POE) Letter of Introduction, which entitles you to receive a work permit upon arrival in Canada, you will know how long you are allowed to stay in Canada on that permit.

This will most likely be for either 12 or 24 months, depending on your nationality. It is important to take out insurance for the full duration of your visa, as the immigration official who stamps the visa into your passport on landing has the right to:

- ask you to produce your insurance policy information.

- limit your work permit to match the duration of your policy (if your policy is valid for a shorter length of time).

Our recommended insurance partners offer policies with a maximum duration of either 12, 18 or 24 months.

2. Can I extend my travel medical insurance policy in Canada?

Some travel medical insurance providers allow you to extend your policy, but some do not. Some allow you to extend, but you have to leave Canada temporarily in order to do so. Make sure you get unambiguous, clear answer for this question if you plan on remaining in Canada.

3. Do you provide winter sports coverage?

Not everybody will be interested in this, but anybody planning on skiing or snowboarding in Canada should be. Most standard policies do not include winter sports coverage, but each of our recommended providers offer it as an add-on.

It’s important to know what you’re covered for as these sports come with a risk of injury, particularly for beginners.

4. If I leave Canada, am I still covered on this policy?

If you want to head to the United States, the Caribbean or elsewhere for a quick visit, will you be covered to the same extent as you will be in Canada? You need to know.

5. What is the extent of your medical coverage?

Will it cover pre-existing conditions? Will it cover non-emergencies? What costs will the insurer pay up front, and what costs do I have to file for reimbursement for? How long does reimbursement take?

6. Do you cover loss/theft of passport?

A simple question, so ensure you get a simple answer from your insurance provider.

7.What is your policy on pre-existing medical conditions?

If you need cover for existing conditions, ask as many questions as you need to about it, and get something in writing before you commit to the policy.

8. Is there an excess waiver, or a deductible and how much is it?

What is a deductible? What is a waiver? What do they do? Insurance companies usually offer an excess waiver which means if you need to claim, you don’t have to pay anything towards your claim.

9. What does that mean?

This may seem simplistic, but could be the difference between peace of mind, security and health on the one hand, and a potentially tricky or risky situation on the other.

When shopping for a travel medical insurance policy in Canada, you are likely to come across industry jargon that you may not understand. Do not be afraid to say ‘sorry, but what does that mean?’ If you are struggling to understand a complex and convoluted paragraph of text or the person at the other end of the phone is using terms that make no sense to you, pinpoint it and get them to repeat it in lay terms.

- Please see our Travel Insurance for Canada page, where you can explore your options with a list of recommended insurance providers.

Related Content

Becoming Canadian

Read more

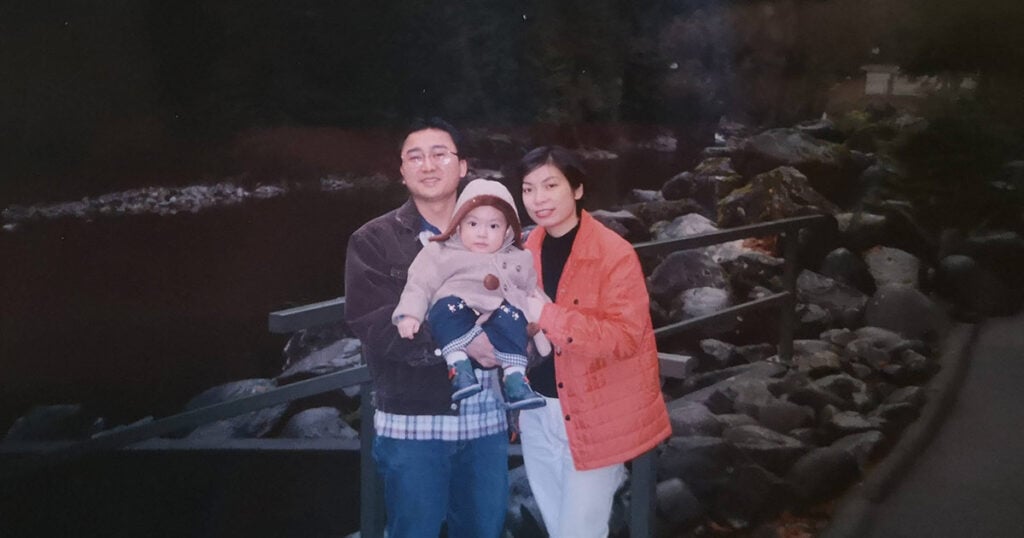

My mother’s journey immigrating from China to Canada

Read more

In Our Place – Dan & Taya’s IEC Working Holiday in Banff

Read more

My year in Canada on an IEC work permit

Read more